- Trader Nomad Newsletter

- Posts

- TRADE SETUP

TRADE SETUP

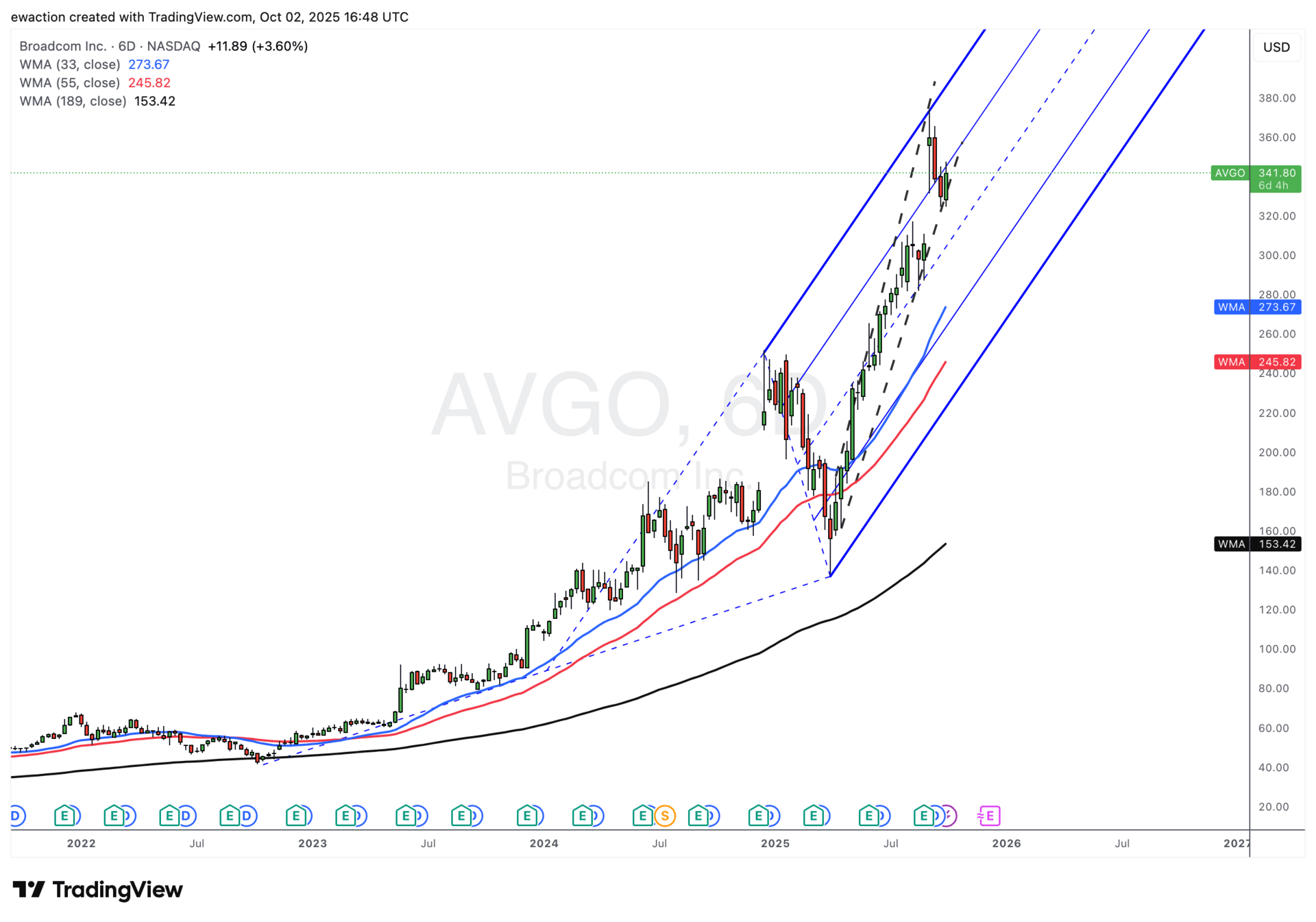

AVGO rejected from the channel top

Where do we stand fundamentally?

Broadcom recently sold a 13-building office campus in Stanford Research Park (~1.1 million sq ft). The divestment is part of its post-VMware acquisition realignment.

The company patched a critical VMware zero-day vulnerability (CVE-2025-41244) that was being exploited in the wild.

It also rolled out its PCIe Gen 6 interface technology for AI data center connectivity, in collaboration with Micron and others.

Broadcom is being closely watched by credit rating agencies: its pivot into AI and software is affecting how agencies view its debt and credit profile.

AVGo is being rejected by the long-term channel top after the big gap up on the earning release and did not continued the rally as the NASDAQ and NVDA are reaching new highs. It could be a signal that the top in the market, tech stocks have reached the top. Looking to short the stock or buy put options.

AVGO 6 days chart

I am taking a near-term short-trade entry with an SL above 360 to target 308 and lower. You can buy put options as well.

AVGO trade setup